Help to Buy ISAs

First-time buyers can get Ј3,000 help to buy a property

Get Our Free Money Tips Email!

For all the latest deals, guides and loopholes - join the 12m who get it. Don't miss out

Updated December 2017

Help to Buy ISAs are a decent option if you're a first-time buyer saving for a mortgage deposit. You can earn up to 2.53% interest tax-free and then the state will add 25% free cash, and it could be Ј1,000s, on top of what you save.

This guide will take you through everything you need to know about Help to Buy ISAs: who can get them, how to use them and what you can do if you change your mind, plus we clear up the can it really be used for a house deposit? confusion and compare them to the new Lifetime ISA. We then give all the best-buy Help to Buy ISA deals.

Best buy Help to Buy ISAs

In this guide

Other top ISA and mortgage guides.

Cash ISAs: The best cash ISAs out there.

ISA transfers: If you're looking to transfer old cash ISAs.

Lifetime ISAs: Info on the ISA for under-40s that launched in April 2017.

Boost your credit score: Tips to get your finances in shape before you buy.

The 15 Help to Buy ISA need-to-knows

You can save up to Ј1,200 in your first month, then up to Ј200 a month after that

If you've got less, you can put in less and it'll still work, and you can keep contributing as long as the scheme lasts.

If you miss a contribution one month, it's not a problem, though you can't make it up the next month (ie, you can still only put Ј200 in the next month).

If I don't have the full Ј1,200, should I wait to open one?

That depends on whether you are able to save more than the Ј200 a month in subsequent months. If you are, then you may as well wait to fill it up to the max – to get the biggest bonus.

If not, don't delay. Get what cash you can in now; that way you earn interest more quickly.

Are my savings safe in a Help to Buy ISA?

Help to Buy ISAs are savings accounts, there is no investment risk. The only risk is the slight one of the bank or building society going bust. Yet all the providers we include have the full UK Ј85,000 safe savings protection and Help to Buy ISAs are covered by that.

The only thing to watch is that this is by banking institution not per account. So if you have other savings in the same place as your Help to Buy savings, it could take you over the limit. If so see the Savings Safety guide for more info.

The state adds 25% tax-free to whatever is in the ISA when you use it to buy a home

Even with all the hype about the new personal savings allowance, if you're a first-time buyer, putting your cash in a Help to Buy ISA (or a new Lifetime ISA) before thinking about any other savings is a no-brainer.

Even with all the hype about the new personal savings allowance, if you're a first-time buyer, putting your cash in a Help to Buy ISA (or a new Lifetime ISA) before thinking about any other savings is a no-brainer.

So at the point you use the ISA to buy your first home, all the money you have put in and the interest will have 25% added to it, with two exceptions:

- You need to have at least Ј1,600 saved to get the bonus (so you'd get Ј400 extra).

- The most you'll get the bonus on is Ј12,000 (so a Ј3,000 bonus). If you have more than that you can still use the ISA to save, you just won't get more than Ј3,000 on top.

How much state top-up you'll get

The bonus scheme's set to keep paying out on Help to Buy ISA savings until December 2030. So you could put in just a small amount per month and take years to build up your bonus. However, you risk a future government changing the rules before 2030, meaning they'll stop paying bonuses.

Is it worth me getting one if I'm buying a home in the next few months?

Yes, definitely. Even if you won't get the maxed-out bonus as you're buying sooner, the Help to Buy ISA is still worth getting. The truth is, house prices can always change, which could negate the benefit of the government bonus anyway.

Instead, get a Help to Buy ISA and pay into it until you're ready to buy. As long as you've saved the minimum of Ј1,600 (which you'll be able to do after three months if you save the maximum amounts), you'll be eligible for the 25% top-up from the Government.

Every first-time buyer aged 16 and over can open one

Anyone can get one, as long as you're a first-time buyer or plan to be in the future and frankly even if you've only an inkling you may buy a house, it's worth starting it off.

You can open one anytime until December 2019 and you'll be able to save in it until December 2029. The bonus will added as long as you use it for a deposit by December 2030.

As for what a first-time buyer is – the definition is strict. It's someone who doesn't own and has NEVER owned an interest in a residential property, either inside or outside the UK, whether it was bought or inherited.

Can I open one for my children? Is it a good idea?

Once children are 16 they can get a Help to Buy ISA and, if you're looking to help them in future, it's a potentially lucrative way to do it. You can then give them money to put in it and, if they later use it for a deposit, they get the 25% added on top. However, they must open the account, not you.

And as I'll explain below, if they decide not to use it for a property, they still get the cash and the interest out, just not the extra 25% on top.

Can 16 & 17 year olds have a Help to Buy ISA and a Junior ISA at the same time?

We checked this with HMRC and it told us that just as you can have a 'normal' cash ISA and a junior ISA at the same time if you're aged 16 or 17, the same applies with a Help to Buy ISA.

However, you must open the Help to Buy ISA yourself in your own name – a parent can't do it for you.

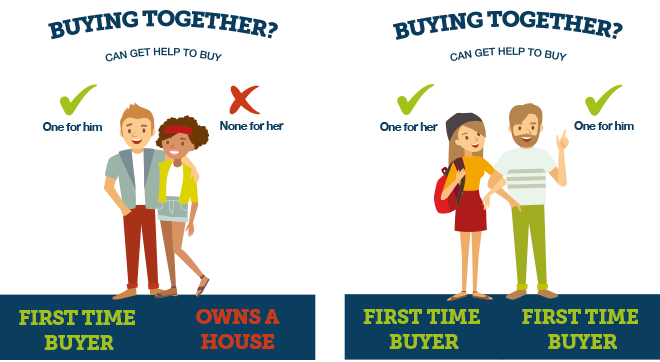

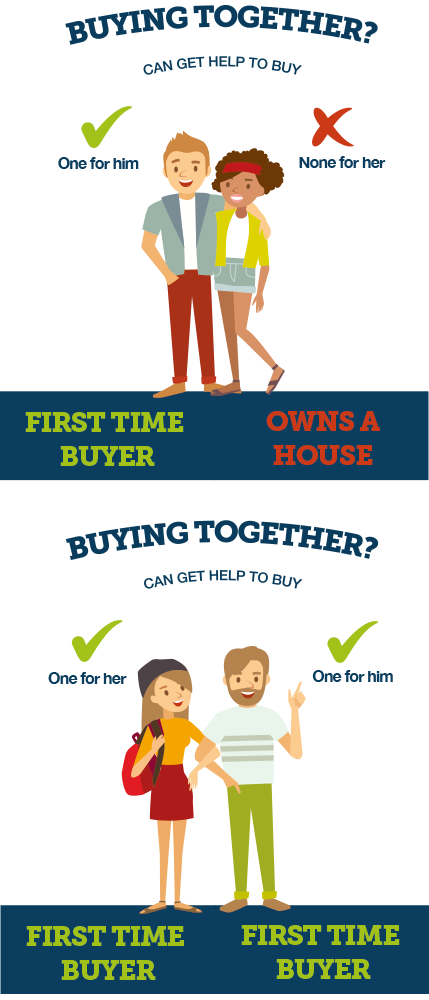

It's an individual product, couples are treated separately

Help to Buy ISAs are for individuals, it's not about who's buying the house, it's simply about whether you're a first-time buyer. To make it plain:

- If you're a first-time buyer, buying with someone who's owned before, you CAN open one, they CAN'T.

- If you're a first-time buyer, buying with another first-time buyer, you CAN BOTH open one. So, together, you can save Ј400 a month and double the bonus.

It can be used for any property costing under Ј250,000 (Ј450,000 in London) and any mortgage

The bonus will only be available on homes worth up to Ј250,000, or Ј450,000 in London (defined as inner and outer London boroughs). Unlike some other government schemes, you're not restricted to buying a new build; any property works – provided you're buying with a mortgage (you won't get the bonus if you're a cash buyer).

- You can use it with any mortgage type, it DOESN'T have to be a Help to Buy mortgage (though it can be), but it must be a residential mortgage, including self-build and shared ownership, but not buy-to-let.

- Do note, though, with shared ownership, that you'll only get the bonus if the total property price is under Ј250,000 (Ј450,000 in London) – it's not based on the price of the proportion you're buying.

- It doesn't need to be your sole deposit money, you can combine it with other savings (see where to save the rest).

You CAN rent out your property if you've used a Help to Buy ISA as part of the deposit

When you use a Help to Buy ISA to buy a home, you sign a declaration saying that you won't rent the property out – the Government's idea is to encourage homeownership, not help people start burgeoning property empires.

But this was such a restriction, we queried it with the Treasury – what happens if people's circumstances change? For example, if you had a job abroad for a couple of years, but wanted to keep the home and move back in when you came back to the UK – would you have to sell the property?

The Government saw the sense in the question, and has now partly relented. you will be able to rent your property out if your circumstances change down the line.

However, if you're buying the property with the sole intention to rent it out, this still isn't allowed. If caught, the government would seek to get its bonus money back from you.

Read full details of our challenge to the Treasury in Martin's can I rent out my home if I used a Help to Buy ISA?

You can only open one Help to Buy ISA, but you can transfer it to up the rate

Unlike a cash ISA – where you can open a new one each tax year – you're only allowed one Help to Buy ISA (ie, from one provider) full stop. But you can continue to add to it each tax year.

And although you're only allowed to get one Help to Buy account, you can transfer it between different providers to chase the best interest rates.

So it's important to monitor the interest rate you're getting and, if it drops, find a new Help to Buy ISA provider paying a better rate (you'll need to ask it to transfer your existing one when you open your new account – don't take the money out yourself).

And of course with the Help to Buy ISA, just like any other ISA, the interest you earn is tax free, so you get to keep all of it.

Get Our Free Money Tips Email!

For all the latest deals, guides and loopholes - join the 10m who get it. Don't miss out

You're not supposed to contribute to a Help to Buy ISA and a cash ISA in the same year, but.

The rules say you can't pay into a cash ISA and a Help to Buy ISA in the same tax year (usually). Though nothing prevents you opening a Help to Buy ISA if you have cash ISAs from previous years, or a stocks & shares ISA from any year.

Doing this is great for those who've already opened a cash ISA this tax year, as you can transfer it in and use some for Help to Buy. If this works for you see the top pick Help to Buy ISA split below.

The only negative for doing this is you may get lower rates on both your Help to Buy ISA and cash ISA by linking them together. If this isn't for you it's worth remembering while a cash ISA lets you save more, getting a Help to Buy ISA still beats it as the 25% state-added bonus is far bigger.

What should I do if I've already opened a cash ISA?

If the amount is less than Ј1,200 (the amount allowed in a Help to Buy ISA in the first month) you can simply transfer it to a Help to Buy ISA. If it's more…

- The most obvious thing is to just transfer it into the top Help to Buy ISA split so you can keep it open and move money into a Help to Buy ISA.

- Or you could withdraw any money you put in a cash ISA this year (and interest from it), then open up a new Help to Buy ISA. Though if you've a lot in, remember the amounts you can put in a Help to Buy ISA are far smaller than the amounts in a cash ISA.

I've used my Help to Buy ISA for a home. Can I now open a cash ISA this tax year or do I have to wait until next?

Yes, you can open a cash ISA once you've closed your Help to Buy ISA.

Normally you can only pay new money in to one cash ISA per tax year (Help to Buy counts as a cash ISA), but a little-known exception to the rule is that you're allowed to pay in to a second (but no more), if you've fully closed the first, not just emptied it.

As you need to fully close the Help to Buy ISA to get the bonus to buy a home, you'd be free to open a new cash ISA this tax year.

You need to get your solicitor to apply for the bonus cash when you buy a home

When you're ready to buy, to get the bonus, you let your ISA provider know that you're closing down your Help to Buy ISA account, and transfer the funds into another account (or your solicitor's account). You'll then receive a closing letter from your ISA provider, which you need to give to the solicitor who is doing your conveyancing (house buying) work for you.

The solicitor then uses the letter to apply online for the government bonus. Beware! Because it's admin work, and takes time, solicitors are allowed to charge up to a maximum of Ј60 (Ј50 + VAT).

The Help to Buy ISA bonus only helps with the mortgage deposit, NOT the exchange deposit

When you're buying a home there are two types of deposit (though the same money's generally used for both). And, as the Government decided you'd only get the Help to Buy ISA bonus at completion (so no one could get it if they pulled out of a property sale), it only helps you with one of these types; and it's important to understand the difference.

The Home Exchange Deposit: During the process of buying a property, after your offer is accepted, once you've checked everything out you normally exchange contracts with the seller. At this point the seller will usually ask you to put down a 10% deposit (sometimes it can be negotiated lower to 5%) to secure the property. After that no one else can trump you as both you and the vendor are committed to the sale.

You then have time to work through your finances and any other issues towards completion which is when you and the mortgage company hand over the remainder of the cash (see Buying a Home Timeline for more).

While you can use the money you've saved in a Help to Buy ISA towards this exchange, it's only at completion that you receive the mortgage money and Help to Buy ISA bonus; so the bonus won't help towards the home exchange deposit.

So, if you are relying on the Help to Buy ISA bonus to get you to 10% (or indeed only have a 5% deposit in total), it could be a problem. However, in most cases, it'll be worth trying to negotiate with the seller (probably via your solicitor) on this.

Be honest with them about the Help to Buy ISA bonus. If the seller wants the sale to go through, they could agree to a lower deposit (possibly with the right to chase you in court for the full 10% if you later pull out).

But, according to brokers we've spoken to, as long as you are upfront about your reliance on the Help to Buy ISA bonus, it shouldn't be a major issue. Most vendors are unlikely to pull out of a house sale because of a small shortfall which will be made good in just a matter of days when you finally complete.

The deposit at completion (sometimes called the mortgage deposit): It is this final deposit when you actually become the legal property owner – not the specific exchange deposit described above – which the Help to Buy ISA bonus is for.

Say you're buying a Ј100,000 property, and have saved Ј8,000 in a Help to Buy ISA; with the bonus you'll have Ј10,000, so a 10% deposit in total. You’d have been able to use your Ј8,000 at the exchange stage but can only get the additional Ј2,000 at this point of completion. That helps to reduce the amount you need to borrow and cuts the cost of your mortgage rate too.

You can take the money out whenever you want even if you're not buying a property

If you decide not to buy your first home (or to buy one costing more than the qualifying amount) you don't lose the money. You can take money out of a Help to Buy ISA whenever you want – you just miss out on the bonus. It'll still be tax-free and you'll still get the interest you're due.

If you decide not to buy your first home (or to buy one costing more than the qualifying amount) you don't lose the money. You can take money out of a Help to Buy ISA whenever you want – you just miss out on the bonus. It'll still be tax-free and you'll still get the interest you're due.

The rules also allow you to make partial withdrawals, while keeping the Help to Buy ISA open (though withdrawal rules will depend on your provider). You won't be eligible for the bonus on the amount withdrawn, but you can still keep contributing afterwards and will still get the bonus on whatever is in the account when you use it for a deposit.

It's this fact that makes the accounts such an attractive option – especially as the Help to Buy ISA rates tend to be higher than normal cash ISAs. So you can put your cash in IN CASE you may buy a home with it, and there's little downside if you don't (barring missing out on the larger tax-free amount you can save in a cash ISA) and a huge upside if you do.

It's worth doing even if you're buying soon and have already saved

The minimum amount you need to get a bonus is Ј1,600 (you would get Ј400) and while that takes 'three months' to do, in practice you can do it far quicker with most accounts. The reason it's three months' worth is because you can deposit Ј1,200 in month one then up to Ј200 in each subsequent month.

Yet as a month is a calendar month, in practice you may be able to do this far more quickly, if the dates fall for you.

For example you could put Ј1,200 in on 31 January, then Ј200 in during February, and the final Ј200 in on 1 March just 30 days later and you'd be ready to go.

Therefore, assuming you're eligible, even if you have savings elsewhere, if you won't be completing within the next month, it's worth moving what you can into the Help to Buy ISA to get the bonus. Do check that your bank allows this – some have a cut-off date each month for paying in.

Should I get a Help to Buy ISA or a Lifetime ISA?

The Lifetime ISA (LISA) launched on 6 April 2017, and just like the Help to Buy ISA, it gives a 25% bonus on top of what you save. The LISA is designed both to help you buy your first home, and to save for retirement, and can be opened by anyone aged 18 to 39.

The main difference is that you can save Ј4,000 a year in a Lifetime ISA, compared with Ј2,400 (Ј3,400 in year one) in a Help to Buy ISA. The bonus is also paid differently – with a Lifetime ISA it's paid annually until April 2018 and then monthly. Plus, with a LISA, you need to wait a year before using it to buy a home, and there's a penalty for early withdrawal.

- You can have both a Help to Buy ISA and a Lifetime ISA – even if the Lifetime ISA is a cash LISA. This is because the Lifetime ISA is a whole new type of ISA

- However you can only use the bonus from one of them towards buying a house.

- Use the LISA for the 25% bonus to buy a home, you won't get the bonus with the Help to Buy ISA, but you can still keep the money plus the interest (and use it towards buying your home).

- Use the Help to Buy ISA for the 25% bonus, and you'd have to pay a penalty to use your LISA savings for a property, though you would still be able to use it and get the bonus for retirement savings.

While the LISA allows you to save more, the Help to Buy ISA wins for some as our tables shows:

You can transfer a Help to Buy ISA into a LISA, but should you?

This is an area many are finding very confusing so let's try and break it down a little.

- Transfer a Help to Buy ISA into a LISA by 6 April 2018 and you get the bonus on ALL of it. If you transfer your Help to Buy ISA into a LISA, you'll get the bonus on that, as well as your LISA savings. The bonus will be added a few weeks after the end of the 2017/18 tax year (so around the start of May 2018). Money transferred in after that doesn't get the extra bonus.

- Transfer, and any Help To Buy ISA contributions made before 6 April 2017 don't eat up your LISA allowance. If you transfer in your Help to Buy ISA before 5 April 2018, all the money you put in it before 5 April 2017 won't impact your Ј4,000 annual LISA allowance. However, any money put in after does – eg, if you put Ј1,000 in your Help to Buy ISA after 6 April 2017 then later that tax year transferred it into a LISA, you will only be able to add Ј3,000 more to your LISA. Read how this works in practice.

Many of you have emailed us with situations like the below, asking what counts towards what allowance, and what gets the bonus. Hopefully, this helps to explain.

Helen Homebuyer opened her Help to Buy ISA in Dec 2015 and saved the max Ј1,200 in the first month, and Ј200/mth since. In April 2017, she has Ј4,400 in her Help to Buy ISA. She'll keep saving in the Help to Buy ISA until June, when the first cash LISA launches. By that time, she'll have Ј4,800 in her Help to Buy ISA.

In June, Helen transfers her Help to Buy ISA into a cash LISA. She's paid Ј400 in to it in the 2017/18 tax year, so this counts towards her LISA allowance, meaning she has Ј3,600 left. She puts this amount into her cash LISA in June 2017 to max it out at the Ј4,000 limit.

At the end of the 2017/18 tax year, she gets a Ј2,100 bonus (Ј1,100 on the Ј4,400 saved before 5 April in the Help to Buy ISA & transferred in + Ј1,000 on the combined amount paid in to the Help to Buy ISA and the LISA in the 2017/18 tax year). Her LISA clock started in June 2017, so she'll be able to use the cash to buy her first home after June 2018.

Helen Homebuyer opened her Help to Buy ISA in December 2015 and saved the max Ј1,200 in the first month, and Ј200/mth since. In April 2017, she had Ј4,400 in her Help to Buy ISA. As there were no cash LISAs available, she's kept saving in the Help to Buy ISA since, so now has Ј5,000 in her Help to Buy ISA (at June 2017).

However, the first cash LISA only pays 0.5% interest. Helen opens it with Ј1 to get the LISA clock running.

But, to max the amount she can earn, Helen plans to keep saving into her Help to Buy ISA paying 2% until March 2018, by which time her balance will be Ј6,600. She'll then transfer in her Help to Buy ISA to the cash LISA. She's paid Ј2,200 in to it in the 2017/18 tax year, so that counts towards her LISA allowance, meaning she has Ј1,799 of allowance left (she put Ј1 in her LISA already). She puts this amount into her cash LISA in March/April 2018 to max it out at the Ј4,000 limit (having kept it in a high-interest bank account in the meantime).

At the end of the 2017/18 tax year, she gets a Ј2,100 bonus (Ј1,100 on the Ј4,400 saved before 5 April in the Help to Buy ISA and transferred in, plus Ј1,000 on the combined amount paid in to the Help to Buy ISA and the LISA in the 2017/18 tax year). Her LISA clock started in June 2017, so she'll be able to use the cash to buy her first home after June 2018.

There is a risk doing this: Skipton has a T&C which allows it to stop accepting transfers in. It hopes not to have to activate it, but if too many people transfer at one time, it could stop them to allow it to give good customer service to all. It may therefore pay to transfer earlier rather than later.

You need to weigh up the risk. Transfer your Help to Buy ISA to a LISA over the summer instead of waiting, and you could lose out on up to Ј50 of interest by saving in the lower-interest LISA.

But wait until March 2018 and if – and it is an if, we don't know the future – there's still only one cash LISA provider, there could be 100,000s trying to transfer their Help to Buy ISAs in. and by then you're running out of time if it then stops transfers. You could lose out on up to Ј1,100 of bonus if you can't transfer in.

Whatever you decide, it's still worth putting the Ј1 in a LISA as soon as possible.

Martin's 'should you transfer your Help to Buy ISA into a Lifetime ISA?' video

This video was recorded in April 2017, before the first cash LISA launched, but the logic remains the same.

Quick question

What if I've transferred in my Help to Buy ISA, but I end up buying before April 2018?

As we say above, in the first year of the LISA (2017/18), you can withdraw funds penalty free, as no bonus has yet been paid. This includes any transferred in Help to Buy ISA funds.

But there's a special case for claiming a Government bonus in this scenario. In fact, you'll still be eligible to claim the bonus on the Help to Buy ISA part, as provided you transferred it into a LISA (as opposed to shutting the account), you have a one-off 12-month window to still use your Help to Buy ISA closure documents – the provider will give you these when you transfer – for your conveyancer to still claim the Help to Buy ISA bonus.

One thing to note is that you will be claiming the Help to Buy ISA bonus, so your home purchase needs to meet the Help to Buy ISA criteria rules rather than the LISA scheme rules – which'll be a problem if your property costs more than Ј250,000 and is outside London. The other thing is that you'll get the cash at completion – it won't be available at exchange.

Where to save for your deposit if you've filled your Help to Buy ISA

We've coloured this number in red as it's not really about Help to Buy ISAs. But, if you've got a lump sum, or you're saving over £200/mth (£400/mth if a couple of first timers buying together), you'll need to save elsewhere too.

- Earn 5% for 1yr on up to £2,500. Open a Nationwide FlexDirect account and you get 5% AER fixed for a year on balances of up to Ј2,500 (1% AER variable after). You can also earn up to 3% with other Top Interest-Paying Bank Accounts.

Get Our Free Money Tips Email!

For all the latest deals, guides and loopholes - join the 10m who get it. Don't miss out

Best Buys Help to Buy ISAs

Two things you need to know about all the products below:

- Anyone can open them, you don't need to bank with that provider.

- If you get one, you don't need to then get that provider's mortgage.

Top open-to-all Help to Buy ISA rate

Barclays 2.53% AER

Barclays pays the top open-to-all Help to Buy ISA rate at 2.53%.

You can manage the account online (if registered), in branch or by phone. It can be opened with just Ј1, though as with all other Help to Buy ISAs, you can put up to Ј1,200 in in the first month. The rate is variable, so keep an eye on it in case it drops in the future.

Payments must be received by the end of the calendar month. You can use standing orders, cash/cheque deposit or bank account transfers to fund the ISA.

Rate: 2.53% | Min deposit: Ј1 | Access: Online/branch/phone | Interest paid: Monthly | Allows previous ISA transfers? Yes | ISA split allowed? No | Min age: 16 | Linked account needed? No | Linked benefits? None | Withdrawal penalty: None

Next highest Help to Buy ISA rate

Virgin Money 2.25% AER

Virgin Money pays the next highest Help to Buy ISA rate that's available to everyone, and you can open it with just Ј1. Like all other Help to Buy ISAs on the market, this is a variable rate, meaning you should monitor it in case it drops.

You can fund the ISA by standing order, cash/cheque deposit or bank account transfer. Note that if you want to transfer in cash from an existing ISA from a provider other than Virgin Money, it has to be from another Help to Buy ISA.

Rate: 2.25% AER variable | Min deposit: Ј1 | Access: Online | Interest paid: Annually or monthly | Allows previous ISA transfers? Yes (must be a Help to Buy ISA) | ISA split allowed? No | Min age: 16 | Linked account needed? No | Linked benefits? None | Withdrawal penalty: None

Same rate as the account above but you can't manage online

Buckinghamshire BS 2.25% AER

Buckinghamshire BS pays the same Help to Buy ISA rate as the Virgin Money account above, and like that one you can open it with just Ј1. You can only open the account by post or in branch so if you want an account with online access, look at the options above.

Like all other Help to Buy ISAs currently on the market, this is a variable rate, meaning you should monitor it in case it drops.

Your initial payment can be made with cash in branch, cheque by post or debit card by phone. Monthly payments after that must be made by standing order between 6th and 20th of every month, or by cheque or cash if in branch.

Rate: 2.25% AER variable | Min deposit: Ј1 | Access: Post/branch | Interest paid: Annually | Allows previous ISA transfers? Yes | ISA split allowed? No | Min age: 16 | Linked account needed? No | Linked benefits? None | Withdrawal penalty: None

Top if you also want a cash ISA in the same year

Nationwide 2% AER

The Nationwide Help to Buy ISA pays 2%, slightly less than the best buys above. Like Aldermore below, it's one of the few that offers a 'split ISA'.

This means it has manipulated the rules to allow you to have a cash ISA alongside a Help to Buy ISA, as it's all in one wrapper.

So if you've already saved in a cash ISA since 6 April 2016 you can transfer it in here, and then move money each month to the Help to Buy ISA, while keeping your cash ISA status. Or, equally, you can open it with new money and save both in the cash ISA and the Help to Buy ISA.

We've put it ahead of the others that allow splits because, even though most have similar Help to Buy ISA rates, Nationwide also has an okay rate on its easy access ISA which pays 0.75% (1% with its Flexclusive ISA for those with a 'Flex' current account).

Rate: 2% AER variable | Min deposit: Ј1 | Access: Online/branch/phone | Interest paid: On account anniversary| Allows previous ISA transfers? Yes | ISA split allowed? Yes | Min age: 16 | Linked account needed? No | Linked benefits? Access 'Save to Buy' mortgages | Withdrawal penalty: None

Decent alternative to Nationwide if you also want a cash ISA in the same year

Aldermore 1.75% AER

The Aldermore Help to Buy ISA pays 1.75%, just a little lower than most other deals. Like Nationwide above, it's one of the few that offers a 'split ISA'.

We've put it ahead some of the others that allow splits because, even though it has a slightly lower Help to Buy ISA rate, Aldermore has the best cash ISA rates of the five. Its 30-Day Notice Cash ISA pays 1.05% (unlimited withdrawals but you must give 30 days' notice each time you wish to make one).

Rate: 1.75% AER variable | Min deposit: Ј1 | Access: Online/post/phone | Interest paid: Monthly/annually| Allows previous ISA transfers? Yes | ISA split allowed? Yes | Min age: 16 | Linked account needed? No | Linked benefits? None | Withdrawal penalty: None

Other providers offering Help to Buy ISAs

It's possible to beat the accounts above on rate, though you'll need to live in a certain area. Here are the providers that offer this:

- Penrith BS – pays 3% AER variable (only available to people who live in Cumbria)

- Cumberland Building Society - pays 3% AER variable (access is branch-only; branches are in Cumbria, Lancashire & Southern Scotland)

- Newcastle BS – pays 2.56% AER variable (access is branch-only; branches are in Northumberland, Tyne and Wear and County Durham)

- Darlington Building Society – pays 2.55% AER variable (only available if you live in DL, DH, SR, TS, YO and HG postcode areas)

- Tipton BS – pays 2.5% AER variable (only available if you live in B, DY, WS or WV postcode areas, or if you had a savings account with Tipton before 23 May 2016)

Get Our Free Money Tips Email!

For all the latest deals, guides and loopholes - join the 10m who get it. Don't miss out

Rather watch than read? Martin Lewis Help to Buy ISA video briefing

Some people find it easier to watch than read – if that's you, here's a quick video to help you understand Help to Buy ISAs.

Join in the MSE Forum Discussion:

Related Guides

Related News

What the * means above

If a link has an * by it, that means it is an affiliated link and therefore it helps MoneySavingExpert stay free to use, as it is tracked to us. If you go through it, it can sometimes result in a payment or benefit to the site. It's worth noting this means the third party used may be named on any credit agreements.

You shouldn’t notice any difference and the link will never negatively impact the product. Plus the editorial line (the things we write) is NEVER impacted by these links. We aim to look at all available products. If it isn't possible to get an affiliate link for the top deal, it is still included in exactly the same way, just with a non-paying link. For more details, read How This Site Is Financed.

Duplicate links of the * links above for the sake of transparency, but this version doesn't help MoneySavingExpert.com: Halifax, NatWest, NatWest, Virgin Money

FREE MoneySaving email

Get this free weekly email full of deals, guides & it's spam free

Revealed: 800,000 could have saved with a prescription 'season ticket' last year

Credit and debit card charges banned from Saturday - what you need to know

Flying Ryanair? It's about to change its hand luggage rules

Wrongly charged by Uber after the driver cancelled? How to get a REFUND rather than credit

Starbucks to trial paper cup charge in central London stores

I averaged 25,420 steps per day (burning 3,880 calories) in 2017 - here’s how.

An important warning to every worker and 9 other need-to-knows from 2017

Martin Lewis video: How to teach your kids about debt and why financial education matters

Should you invest in Bitcoin? Four things you need to know

Premium Bond rate boosted from 1.15% to 1.4% - should you pile in?

Five top package holiday booking codes, eg, Tui Ј150 off Ј1,000 – DON’T book until you’ve checked our list

Cadbury's 'hunt for the white Creme Egg' competition to win up to Ј2,000

Can you find super-cheap post-Christmas chocs? 29p Cadbury Santa, Ј7.50 Ferrero Rocher & more

LAST OOOOORDERS! Don’t be caught out. The deadlines for free and cheap delivery before Christmas are FAST approaching

Up to Ј56 of make-up for less than Ј20, eg, No7, Max Factor & Essie.

Tools & Calcs

Cheap Energy Club

We ensure you're on the cheapest tariff

Loans Eligibility

All of the top unsecured personal loans

Credit Card Eligibility

Tools for different credit card types & purchases

Mortgage Best Buys

Compares thousands of mortgages

Mortgage Calculator

Eight calcs for all your mortgage sums

Free complaints tool

Resolver - the automated complaints system

How this site works

We think it's important you understand the strengths and limitations of the site. We're a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can't guarantee to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances and remember we focus on rates not service.

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We don't as a general policy investigate the solvency of companies mentioned (how likely they are to go bust), but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips).

- We often link to other websites, but we can't be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySupermarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

More tools from MoneySavingExpert

Budget Planner

Free tool to analyse your finances and scrutinise spending.

Premium Bonds Calc

Unique tool uses probability to estimate winnings.

EBay Local Deals Mapper

Find cheap pick-up only items near you - they often attract fewer bids.

Credit Club

Turbo boost your credit chances and get your free Experian credit report.

Credit Card Eligibility Calc

Shows which top cards you're most likely to get.

MegaShopBot.com

Instantly searches the best shopping comparison sites.

Cheap Energy Club

Ensures the cheapest energy deal constantly.

TravelMoneyMax.com

Find the best online deal for

your holiday cash.

Martin Lewis is a registered trade mark belonging to Martin S Lewis.

Get Our Free Money Tips Email!

For all the latest deals, guides and loopholes - join the 12m who get it. Don't miss out

No comments:

Post a Comment